- HOME

- GET STARTED

- The Survey Sample

- The Fallacy of the Budget and the Significance of Staying Power

- The Fallacy of Credit Ratings

- The Fallacy of Forbes "College Financial Grades"

- The Fallacy of Net Asset Value

- The Fallacy of Revenue Diversification

- The Harsh Reality

- The Principal Findings of The 2024 New England Survey

- The West Coast Survey

- The Economics of Phased Downsizing

- The Economics of a Merger

- In Closing (w/ Resources)

- Postscript

- Ranking 44 Survey Schools

- Comp. Metrics - Intro.

- Comp. Metric Tables

- Principal Investigator

The Fallacy of Forbes "College Financial Grades"

There are a few resources that attempt to assess the financial well-being of colleges and universities for people other than prospective buyers of their bonds, particularly prospective students and their parents. And one would assume these resources would be of interest to current students, staff, faculty, leadership, and governing boards as well.

The "College Grade Report" that is published annually by Forbes is the best known resource of this type. Forbes uses a rating scheme that is similar to those used by bond rating agencies like Moody's and NECHE, the regional accreditation commission that serves New England.

Forbes relies on 9 metrics. The one given the greatest weight (17.5%) is Endowment Asset Value per FTE. Now, the fact that at least 5 of the remaining 8 criteria are, arguably, derivatives of the first to one degree or another tends to expose what seems like a bias on Forbes' part.

And it follows that since the absence of a significant endowment was a criterion for inclusion in The 2024 New England Survey, the Forbes "Grade" is not particularly relevant for the population of private mainstream colleges and universities that are the subject of this study and their tuition-dependent counterparts across the country. By definition, this critical segment of the industry starts off behind the 8-ball in 2024 on 17.5% of the total score and all the endowment criteria’s embedded significance to many of the other grading criteria.

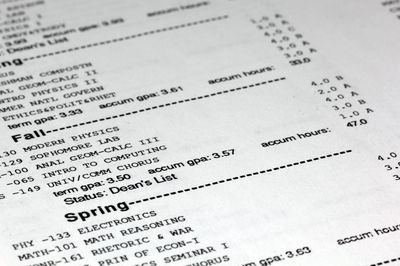

Leaving That Aside: As noted , 31 of the 44 schools in The 2024 New England Survey are rated “at-risk” if enrollments decline by 15%. See here how the Forbes “grades” for these 31 at-risk schools correlate with the months of cash they have on hand and their Staying Power, also in months, not years, with a 15% decline in enrollment:

It is not clear how schools would earn A’s and B’s if they could only generate enough cash from operations to carry on normally for about a year if their enrollments decline by the amounts predicted for the industry as a whole.

Perhaps Forbes should reread the excellent article by Frederick Hess it published in September 2023:

Grade Inflation is Not a Victimless Crime

There are websites with no professional standing that run with these grades and list the "colleges most likely to fail", which, of course, does little to help these schools as they deal with whatever financial challenges they may have.

The 2024 New England Survey is neither designed nor promoted for the purpose of predicting closures and it will not publish statistics on individual schools. It is a fact-based risk assessment and warning to vulnerable schools to anticipate the possibility of declining enrollment and do what can be done in advance to mitigate potentially adverse outcomes.

Copyright © 2025, Abenaki Analytics LLC, Steven M Shulman. All Rights Reserved.

Powered by GoDaddy